For those of us who maintain detailed forecasts of the global defense market, there are few times as exciting as the annual release of the new Future Years Defense Program (FYDP) budget and the 30-year shipbuilding plan. The long-range plan lays out the path that must be taken by industry to build the capability required by the U.S. Navy.

For the long-range plan to be carried out, the first step is executing the FYDP plan through fiscal 2029, per the president’s budget request, which provides plenty of insight into the expectation for ship construction timelines and statuses.

These ship-by-ship details provide insight into recent performance, the changing of expectations and the difficult road ahead for the long-range plan.

The plan outlines an ambitious increase in the number of active battle force ships to meet the goal of an eventual 381 ships (plus 134 unmanned vessels). It shows increasing deliveries effectively across all ship categories through the late 2030s in a baseline plan, and provides an alternative with fewer procurements, but both begin with the assumption that FY25-FY29 FYDP expectations will be met.

Navy leaders recently executed a 45-day review of shipbuilding performance, which highlighted several delays to big-ticket programs. Our analysis of some of these major programs, including the outcome of the 45-day review, shows that the steadily increasing construction spans, paired with an outlook of increasing demand on shipbuilders, will not aid improvement.

Submarines

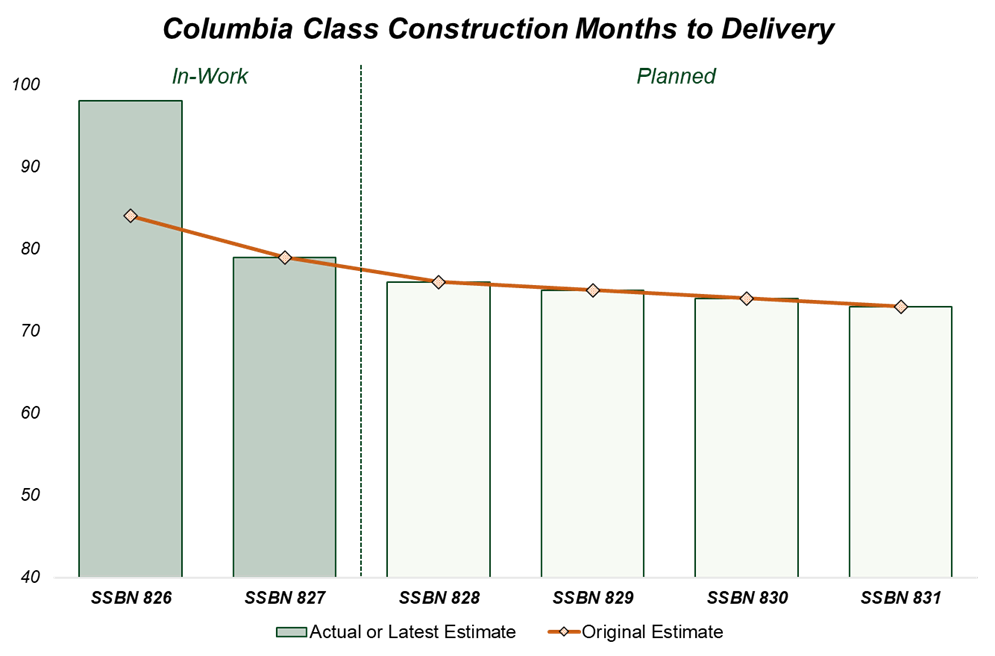

The Columbia-class submarine is the highest-priority shipbuilding program, and building it according to plan is required for the Navy to stay at the threshold of 10 ballistic missile submarines. Columbia construction has been historically prioritized to the detriment of the Virginia class so that Columbia can use more attention and resources from the shared shipbuilder (ideally to shield Columbia from delays).

According to the recent shipbuilding review, the first boat, SSBN-826, is now 12 to 14 months behind schedule.

While the second boat is not yet officially delayed, it is hard to imagine the construction spans dropping from what is now nearly 100 months for the first boat down into the 70s for SSBN-827 and all subsequent units. Given the second boat is only scheduled to begin construction in FY24, it is too early to see the extent to which SSBN-826 issues will impact SSBN-827 and beyond. One would expect delays for SSBN-827 and onward, especially considering the two boats being built in FY24 are planned to grow to six by FY28.

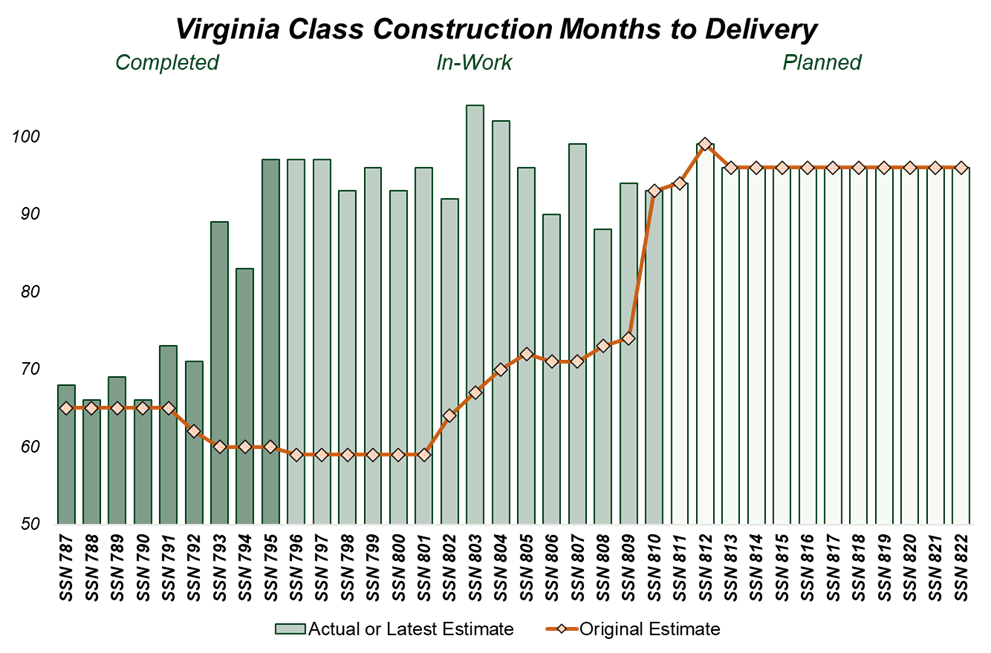

The Virginia-class program has experienced large delays over recent years as production has ramped up. But for what it’s worth, the Navy has begun incorporating more realistic expectations in its plans.

Since 2019, the number of months required to build each ship has risen from 68 months per boat to 85 months for the four most recently delivered boats, and is planned to be 95 months on average for all boats currently under construction.

This increase in construction months has been in line with a ramp-up in production as the number of ships being built has risen from 12 in 2019 to 15 in 2024, and is expected to climb to 18 by the end of the decade. Per the FYDP, planned boats are expected to remain around 95 months on average, which appears to be reasonable given recent history.

With the higher-priority Columbia program now officially experiencing delays — which may become more severe — and with Virginia construction ramping up to 18 boats at a time, maintaining the same level of efficiency will be a victory in itself.

Destroyers

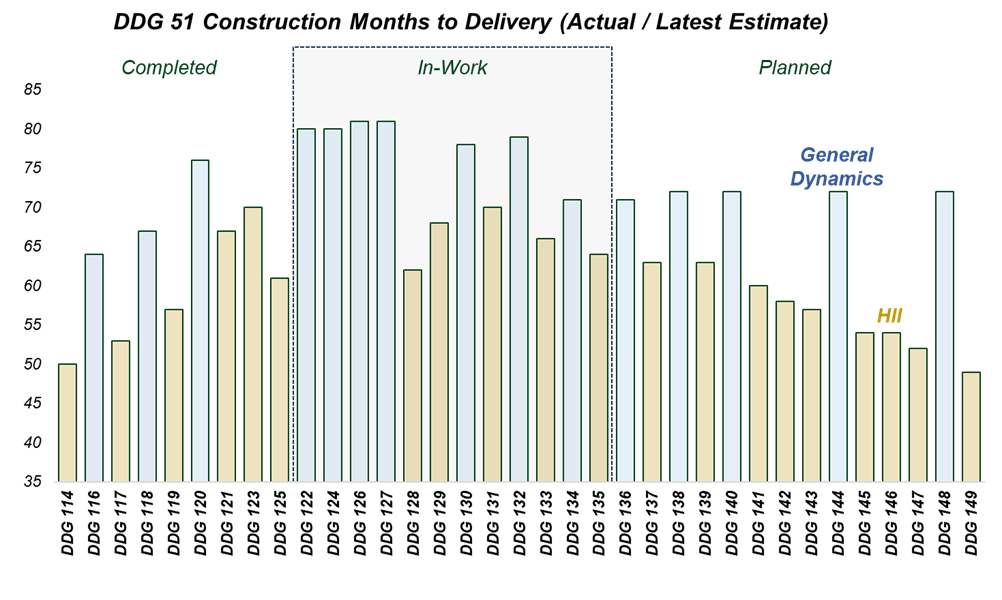

Procurement of the Arleigh Burke-class destroyer is planned to continue until FY32, when procurement for the next-generation destroyer DDG(X) should begin.

Between those boats recently delivered and those that have already begun construction, the average actual or planned construction is roughly 70 months per boat and has been trending upward.

The nuance is that the performance is largely unique to the shipyards. DDG-51s are split between General Dynamics’ Bath Iron Works and HII. Those ships under construction or completed by HII average 62 months per boat, while those by General Dynamics average over 75 months per boat.

This disparity in performance is also reflected in the Navy’s forecast, where HII is expected to drive improvement to the program with construction spans eventually dipping below 50 months, while General Dynamics boats are never expected to break 70.

Whether the issues at Bath Iron Works are due to the beleaguered DDG-1000 program still being wrapped up there or other causes, naval planning is clearly not expecting much to change in terms of DDG-51 construction, besides allocating fewer boats to build going forward.

Meanwhile, HII will be expected to improve construction time by a double-digit percentage while taking on the lion’s share of the work, going from six ships under construction in 2024 to at least nine by the end of the decade.

Aircraft carriers

CVN-79 and CVN-80 are each delayed by more than two years compared to original delivery plans, while CVN-81 is still on schedule. This is largely attributed to CVN-81 being procured in a two-carrier contract, which allowed for procurement efforts to be spread over a much longer period since contract signing.

This gives CVN-81 a longer planned construction span and means less work has been completed, even though construction has technically been ongoing for a few years.

It is still yet to be known if CVN-81 will really be built to schedule, given the keel laying is still a few years away.

Frigates

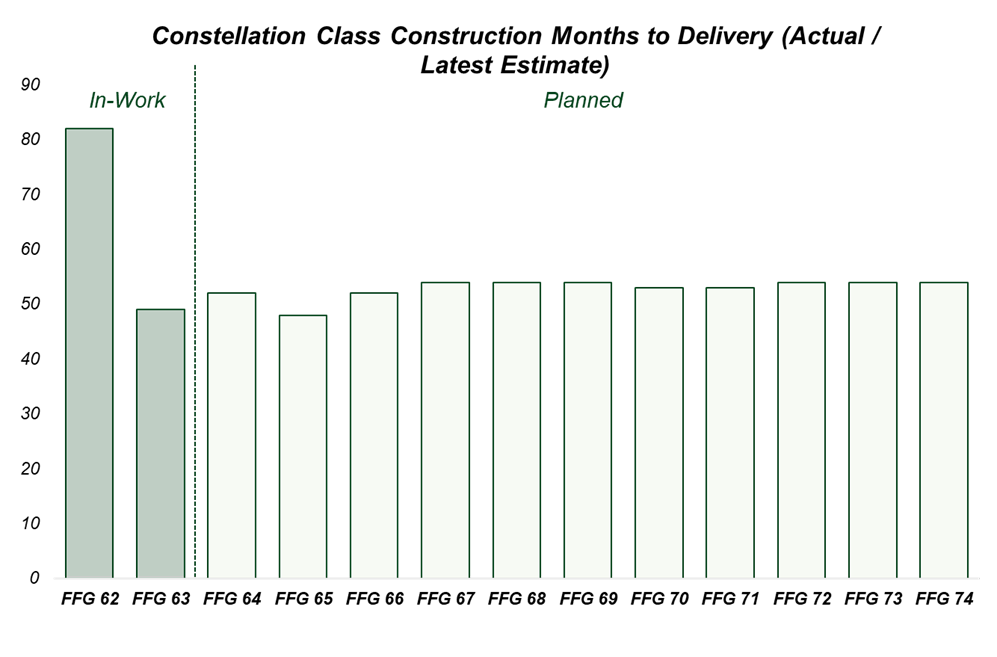

It’s early days for the Constellation-class guided-missile frigates, but the program is already looking at delivery delays.

Coming out of the recent shipbuilding review, it has been reported that the lead ship, FFG-62, is now expected to be delivered 36 months late. This puts the total construction time for the boat at more than seven years, nearing double the original estimate of four years.

Issues have been attributed to shipbuilder Marinette Marine now managing three programs, including the Littoral Combat Ship program and the Saudi Multi-Mission Surface Combatant. The Navy has stated that it’s taking steps to improve the process.

Given the second ship was only slated to begin the construction process in December 2023, it’s too soon to identify the extent to which these issues will continue — not only for the lead ship, but spread to the next ships beginning construction.

According to the latest plans, the shipbuilder is expected to go from potentially three ships underway in 2024 to more than 10 of the class under construction by 2028, while simultaneously bringing construction spans back down to planned levels. Assuming some level of delay continues for even just the first few hulls, the profile of small surface combatant deliveries and fleet size outlined in the 30-year plan has the potential to shift.

The problems plaguing U.S. shipbuilding have been attributed to multiple factors, from the cutting down of the industrial base in the 1990s to the impacts of COVID-19 on the supply chain in recent years.

Whichever issues can be argued for recent performance on these specific programs, construction performance has not been trending in the right direction, and much of the plan for the upcoming years looks ambitious given where things stand.

For industry to execute the plans in the FYDP, and therefore follow the path that provides the Navy with the capability it needs, major improvements will have to be made.

The shipbuilding community has its work cut out for it.

Theo Egan is a co-founder of Tamarack Defense, a data analytics and advisory firm.